by Shideh Kerman, BS, MBA

How can we save money by choosing the right Health Insurance plan?

Has this question ever crossed your mind? If yes, let me tell you that you are not the only one who had thought about lowering your medical insurance costs every time you see the high insurance premium expense or when you pay copays when visiting a doctor.

Three things you need to know when you are picking your health insurance:

- Decide what level of coverage you need that year.

- Review the total cost of your health plan.

- Check the plan network.

- Decide what level of coverage you need: The “metal” categories.

The Affordable Care Act (ACA) has prompted health insurance companies to offer health care plans in four categories. The category you choose determines how you and your plan share the costs of care. This structure helps make it easy to compare health care plans from a range of companies.

The Affordable Care Act (ACA) has prompted health insurance companies to offer health care plans in four categories. The category you choose determines how you and your plan share the costs of care. This structure helps make it easy to compare health care plans from a range of companies.

The plans are divided into four “metal levels,” plus catastrophic.

Plan Insurance Patient

Category Pays Pays

Platinum 90% 10%

Gold 80% 20%

Silver 70% 30%

Bronze 60% 40%

If you are under 30 years of age, you might be eligible to apply for a Catastrophic coverage. For more info go to the CMS website at https://www.cms.gov.

Just like car insurance, you pay for it hoping you never need to use it. Health insurance is for unpredictable and fundamentally serious health problems that occur in people’s lives. Health insurance covers these costs and offers many other important benefits.

In general if you are healthy and don’t need to visit the doctors, a bronze plan might be better choice. But if you need to see the doctor often and or have planned surgeries, having a plan that offers more coverage will save you a lot of money.

- Total Cost of your health plan.

You pay for health insurance in two ways:

- The monthly premium that you pay to purchase your plan.

- The fees you pay when you receive medical care. Those are some combination of

- Copay

- Deductible

- Coinsurance

- Out-Of-Pocket

COPAY — A copayment or copay is a fixed payment for a covered service, paid when an individual receives certain types of service.

For example, you might pay $50 for a doctor’s visit and the insurance company will pick up the rest. Plans with higher premiums generally have lower copays, and vice versa. And some plans do not have copays at all. They use other methods of cost sharing.

DEDUCTIBLE — The amount you owe for covered health care services before your health insurance plan begins to pay.

For Example, if your deductible is $2,500, then you would pay cash for the first $2,500 in health care you receive each year, after which the insurance company would start paying its share.

COINSURANCE — Is your share of the costs of a service that is covered by your health insurance.

For example if you need a CAT Scan that costs $1,500, you might pay 30 percent ($450). And your insurance company will pay the other 70 percent ($1,050). Plans with higher premiums generally pick up a larger portion of the bill.

OUT-OF-POCKET LIMIT — Out-of-pocket costs include deductibles, coinsurance, and copayments for covered services plus all costs for services that aren’t covered. Once you hit this limit, the insurance company will pick up 100 percent of your costs for the remainder of the year. Most people never pay enough for health care services to hit the out-of-pocket limit but it can happen if you require a lot of costly treatment.

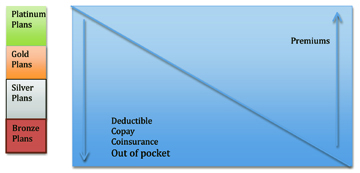

In general, if you pay a higher premium upfront, you will pay less when you receive medical care, and vice versa. Below graph demonstrates how premiums affect out of pocket paid.

- Check the plan network.

Every health insurance plan has a network of providers such as doctors, hospitals, laboratories, imaging centers, and pharmacies that have signed contracts with the insurance company agreeing to provide their services to plan members at a specific price.

If a provider is not in your plan’s network, the insurance company may not cover the bill, or may require you to pay a much higher share of the cost. So if you have doctors you want to continue to see, you will want them to be in the plan’s network. Some most common networks are PPO, POS and HMO plans.

Preferred Provider Organizations (PPOs): PPOs give you the choice of getting care from in-network or out-of-network providers. You pay less if you use providers that belong to the plan’s network.

Point-of-Service (POS) Plans: POS plans let you get medical care from both in-network and out-of-network providers. If you have a POS plan, you’ll choose a primary doctor from a list of participating providers. Your primary doctor can refer you to other network providers when needed.

Health Maintenance Organizations (HMOs): HMOs usually limit coverage to care from providers who work for or contract with the HMO. An HMO generally won’t cover or has limited coverage for out-of-network care except in an emergency.

What plan is the right one for you depends on your health, your financial situation and the providers that you prefer to provide care for you.

- If you already know you have an expensive medical condition, consider a plan with a higher premium that covers more of your costs.

- If you are generally healthy you might come out ahead paying a lower premium and a bigger share of your health costs, because those costs are most likely not going to be that high. Of course, you need to be prepared to pay more if you do unexpectedly become sick or injured.

- If you have a primary care physician and specialists you like, be sure they’re in the network of any plan you consider buying.