by Mark Smiley | Mar 25, 2016 | Feature Story Middle Left

Try For A Merit Scholarship

by Sara Zessar

Despite the constant increase in college tuition, statistics show that a college degree remains a worthwhile investment in terms of the increase in lifetime earnings. However, many middle and even upper-middle class families are facing a dilemma when it comes to financing their kids’ college education. They are unable to qualify for need-based financial aid, yet they don’t have enough money to pay full-price at a private college.

The total cost of attendance at many private schools now exceeds $60,000, and even if parents have saved diligently, they may not have enough. The average student loan debt for the college Class of 2015 was $35,000; that number, like tuition, increases every year. So what are students to do if their parents can’t afford a college’s “sticker price” and don’t qualify for need-based aid, and the students don’t want to take out tens or hundreds of thousands of dollars in loans to make up the difference?

The answer is merit scholarships. When people hear those words, they often think of scholarships from charitable organizations or corporations or those based on unusual characteristics like being left-handed or having red hair. (Yes, such scholarships exist). However, these private scholarships only account for 4 percent of total financial aid awarded, and they often are small amounts and are not renewable.

In contrast, merit scholarships from colleges may cover as much as the full cost of attendance and often can be renewed for up to four years. These scholarships can be based on a number of factors, including grades, test scores, activities, leadership, community service, and/or demographics. For students who are early in their high school career, taking challenging classes, getting good grades, and participating in activities will improve your likelihood of receiving a merit scholarship.

It’s important to note that colleges in the Ivy League and some other highly selective schools do not offer merit-based aid, so for families who need such aid, students may have to set their sights a little lower. If you are willing to consider schools that are less selective, sometimes only slightly less selective, you may have the opportunity to get merit aid.

To assess your chances of receiving merit money from a college that awards scholarships based on grades and/or test scores, compare your GPA and scores to the average GPA and scores of students who have been accepted to that college. If your numbers are above the averages, you have a good chance of getting merit aid. Another thing that can help increase your chances for a merit scholarship is if you live in a state or region that no or few of the college’s current students call home.

Some colleges automatically consider students for merit scholarships when they apply for admission, while others require students to complete a separate application or applications. Still other schools have scholarships for which students must be nominated. As you’re researching colleges and deciding where to apply, be sure to find out what you must do in order to be considered for a merit scholarship. You wouldn’t want to miss out because you forgot to fill out a special form or write another essay.

Students do not have to be at the top of their high school class or have perfect test scores to receive a merit scholarship. For example, one of my students this year has a weighted GPA of 3.828, with a mix of A’s, B’s, and C’s. He attends a large public high school in Denver and is in the top 40 percent of his class. He got a 30 on the ACT. (A perfect score is 36.) He was offered $22,500/year from The College of Wooster, a small liberal arts college in Ohio.

Even a few thousand dollars per year will help defray the cost of a college education, thus benefiting both students and their parents. Sometimes, students receive so much merit-based aid from a private school that it actually becomes cheaper than attending an in-state public college. Therefore, you should never rule out a college based on its sticker price, as you never know how much scholarship money it might offer.

Sara Zessar, the founder of Discovery College Consulting, LLC, has assisted hundreds of students with the college search and admissions process. With an M.Ed. in counseling, Sara worked for six years as a high school counselor in private, public, and charter schools. She also assists students with the scholarship process, and Discovery College Consulting’s students have received up to $33,000/year in college merit scholarships.Visit www.discoverycollegeconsulting.com.

by Mark Smiley | Feb 29, 2016 | Feature Story Middle Left

by Shideh Kerman, B.S., MBA

How healthy are Coloradans in comparison to the rest of the nation? Better grades for children, less so for seniors.

This year’s Colorado health report card was released on Feb. 16, 2016. The Colorado Health Foundation has published the Colorado Health Report Card yearly since 2006. The study provides a benchmark for measuring progress on some of our state’s most important health issues across 38 key health parameters, which are measured through five life stages such as healthy beginnings, healthy children, healthy adolescents, healthy adults and healthy aging.

It offers a glimpse into where Colorado is making headway to becoming a healthier state and critical areas that still need improvement.

In the “Healthy Beginnings” category, which looks at indicators such as prenatal care and childhood vaccination rates, Colorado improved from last year from a C to C+. The main reasons for the bump are an increase in preschool vaccination rates, and decreases in infant mortality and the percentage of expectant moms who don’t get prenatal care.

For the first time since the report card rankings came out, Colorado cracked the top 10 for women receiving timely prenatal care saying only 11 percent now wait until their third trimester for medical care or skip it altogether. The state placed sixth this year up from 41st in 2008.

The state’s children got just a bit healthier last year but still couldn’t muster better than a C+. The reason is we dropped from 14.1 percent of children being uninsured in 2007 to only five percent of children in Colorado who are uninsured today. Decreases in the percentage of children without health insurance had a major effect on improving children’s health. There was little change on the other four indicators, which looked at obesity, physical activity, dental health and medical care.

Teenagers are leading the way toward a healthier Colorado. Teen pregnancies are at a record low in Colorado, with many teenagers reporting they use of protection during sex.

Among teens, “the percentage who were sexually active reached a high of 31.8 percent in 2013, but fell to 23.3 percent in 2016, the lowest rate in the nation,” the report said.

On a related measure, Colorado has nearly halved its teen birth rate in the past decade. Colorado now ranks 18th in the nation, up from 36th.

Now for the bad news: Adults lost their number one spot for most physically active residents, coming in second to Oregon. Colorado adults also lost the nation’s top ranking for diabetes, falling to fourth, as the percentage with the disease rose to 5.3 from 4.5.

Colorado’s seniors grade declined a bit from last year from a A- to B+. Our seniors still score well compared with seniors across the nation but we didn’t do well in areas of receiving the recommended immunizations and flu shots and having a personal doctor.

“Overall, Colorado’s health has improved in the last decade,” said Michele Lueck, the health institute’s president. “We seem to be doing better in the categories of healthy babies and healthy kids.”

Those are among the 10 top achievements cited by the report.

Colorado has tackled arguably its biggest issue by cutting the rate of uninsured residents by more than half from 2013 to 2015. But now it’s time for our officials to turn their attention to the areas that we need improvement like lack of access faced by even the insured to certain services or educating our children to overcome obesity.

by Mark Smiley | Jan 29, 2016 | Feature Story Middle Left

by Shideh Kerman, BS, MBA

How can we save money by choosing the right Health Insurance plan?

Has this question ever crossed your mind? If yes, let me tell you that you are not the only one who had thought about lowering your medical insurance costs every time you see the high insurance premium expense or when you pay copays when visiting a doctor.

Three things you need to know when you are picking your health insurance:

- Decide what level of coverage you need that year.

- Review the total cost of your health plan.

- Check the plan network.

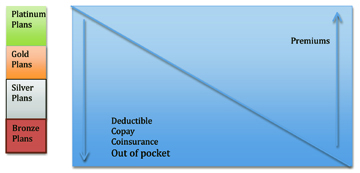

- Decide what level of coverage you need: The “metal” categories.

The Affordable Care Act (ACA) has prompted health insurance companies to offer health care plans in four categories. The category you choose determines how you and your plan share the costs of care. This structure helps make it easy to compare health care plans from a range of companies.

The Affordable Care Act (ACA) has prompted health insurance companies to offer health care plans in four categories. The category you choose determines how you and your plan share the costs of care. This structure helps make it easy to compare health care plans from a range of companies.

The plans are divided into four “metal levels,” plus catastrophic.

Plan Insurance Patient

Category Pays Pays

Platinum 90% 10%

Gold 80% 20%

Silver 70% 30%

Bronze 60% 40%

If you are under 30 years of age, you might be eligible to apply for a Catastrophic coverage. For more info go to the CMS website at https://www.cms.gov.

Just like car insurance, you pay for it hoping you never need to use it. Health insurance is for unpredictable and fundamentally serious health problems that occur in people’s lives. Health insurance covers these costs and offers many other important benefits.

In general if you are healthy and don’t need to visit the doctors, a bronze plan might be better choice. But if you need to see the doctor often and or have planned surgeries, having a plan that offers more coverage will save you a lot of money.

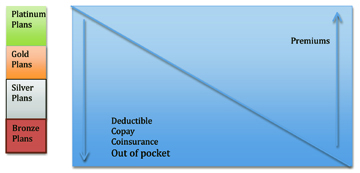

- Total Cost of your health plan.

You pay for health insurance in two ways:

- The monthly premium that you pay to purchase your plan.

- The fees you pay when you receive medical care. Those are some combination of

- Copay

- Deductible

- Coinsurance

- Out-Of-Pocket

COPAY — A copayment or copay is a fixed payment for a covered service, paid when an individual receives certain types of service.

For example, you might pay $50 for a doctor’s visit and the insurance company will pick up the rest. Plans with higher premiums generally have lower copays, and vice versa. And some plans do not have copays at all. They use other methods of cost sharing.

DEDUCTIBLE — The amount you owe for covered health care services before your health insurance plan begins to pay.

For Example, if your deductible is $2,500, then you would pay cash for the first $2,500 in health care you receive each year, after which the insurance company would start paying its share.

COINSURANCE — Is your share of the costs of a service that is covered by your health insurance.

For example if you need a CAT Scan that costs $1,500, you might pay 30 percent ($450). And your insurance company will pay the other 70 percent ($1,050). Plans with higher premiums generally pick up a larger portion of the bill.

OUT-OF-POCKET LIMIT — Out-of-pocket costs include deductibles, coinsurance, and copayments for covered services plus all costs for services that aren’t covered. Once you hit this limit, the insurance company will pick up 100 percent of your costs for the remainder of the year. Most people never pay enough for health care services to hit the out-of-pocket limit but it can happen if you require a lot of costly treatment.

In general, if you pay a higher premium upfront, you will pay less when you receive medical care, and vice versa. Below graph demonstrates how premiums affect out of pocket paid.

- Check the plan network.

Every health insurance plan has a network of providers such as doctors, hospitals, laboratories, imaging centers, and pharmacies that have signed contracts with the insurance company agreeing to provide their services to plan members at a specific price.

If a provider is not in your plan’s network, the insurance company may not cover the bill, or may require you to pay a much higher share of the cost. So if you have doctors you want to continue to see, you will want them to be in the plan’s network. Some most common networks are PPO, POS and HMO plans.

Preferred Provider Organizations (PPOs): PPOs give you the choice of getting care from in-network or out-of-network providers. You pay less if you use providers that belong to the plan’s network.

Point-of-Service (POS) Plans: POS plans let you get medical care from both in-network and out-of-network providers. If you have a POS plan, you’ll choose a primary doctor from a list of participating providers. Your primary doctor can refer you to other network providers when needed.

Health Maintenance Organizations (HMOs): HMOs usually limit coverage to care from providers who work for or contract with the HMO. An HMO generally won’t cover or has limited coverage for out-of-network care except in an emergency.

What plan is the right one for you depends on your health, your financial situation and the providers that you prefer to provide care for you.

- If you already know you have an expensive medical condition, consider a plan with a higher premium that covers more of your costs.

- If you are generally healthy you might come out ahead paying a lower premium and a bigger share of your health costs, because those costs are most likely not going to be that high. Of course, you need to be prepared to pay more if you do unexpectedly become sick or injured.

- If you have a primary care physician and specialists you like, be sure they’re in the network of any plan you consider buying.

by Mark Smiley | Dec 17, 2015 | Feature Story Middle Left

Primary Care, Urgent Care Or Emergency Room?

Choosing The Most Suitable Level Of Health Care

Is Key To Manage Your Health Care Costs

by Shideh Kerman, BS, MBA

Inappropriate use of health care raises medical costs for everyone. Many of us don’t know where to go for our health care needs. It is very common that people become confused with the difference of family practice, emergency rooms and urgent cares.

A study conducted by the National Center of Disease Control in 2011 found that 79.9 percent of adults visited the emergency room due to lack of access to other providers and not necessarily because of the medical emergent situation.

Anyone who has visited an emergency room knows that it can be very costly and it’s not always necessary to go to a ER. Walk-in clinics or urgent care clinics typically offer the equivalent medical attention in 30 to 60 minutes, while a hospital ER incurs a wait-time up to four hours. In addition the ER costs for the same procedure are about 4-5 times higher.

For example, the costs of being seen for an IV (intravenous) can vary widely, depending on where treatment is sought. The same diagnosis and treatment come with very different price tags (lab fees may be additional).

Typical family practices and convenience care clinics such as those at pharmacies cannot perform such procedures. Walk-in clinics offer these services for about $130-$195. In an urgent care the same procedure will cost $140-$250. If you choose to go to the ER, the cost will be highest at around $800-$1,200.

To clear up all of the confusion, here is an easy to follow guide that differentiates primary care provider office visits, urgent care visits and emergency room visits, so patients can be confident with the doctor visit they’ve chosen.

Primary Care Provider Office Visits

A primary care provider (PCP) is a family physician, who takes care of a patient’s basic needs across a wide continuum of different problems. He or she is the first point of contact for a person with a medical or health concern and gets to know the patient personally over time. The primary care provider cares about the patient’s whole health condition including aspects of preventative care such as immunizations, mammograms and colonoscopies. This provider makes sure the patient receives the proper care and coordinates with specialists as needed.

Primary care practices provide health promotion, disease prevention, health maintenance, counseling, patient education, diagnosis and treatment of chronic illnesses in a variety of health care settings such as office, inpatient, long-term care, home care, day care, etc,.

Primary care practices are usually not set up to see patients with acute illnesses or injuries, since most of them are not equipped with x-ray and in-house laboratory.

The copay of primary care provider visits are often the lowest copay defined on health plans. And that is why we encourage patients to visit their primary care provider if available. For some illnesses, if your symptoms come on gradually or you already know the diagnosis, such as a urinary tract infection, you may want to try to get a same day appointment with your primary care provider. While urgent care clinics or emergency rooms are always available, your primary care physician will have a better picture of your overall health for a more accurate diagnosis.

Urgent Care Visits

Urgent care clinics are walk-in clinics and can handle a variety of conditions that need to be treated right away but are not a life or limb threatening emergency.

“I can’t wait..it’s URGENT!”

An urgent care is an option for when primary care provider appointments are unavailable or if you need treatment outside of office hours. If you wait days or weeks for an appointment with your primary care physician, you run the risk of your condition getting worse and requiring more complex treatment.

In addition urgent care is also a good option for any acute illnesses and injuries since it offers x-ray and lab services in-house, which can provide the results within minutes and allow the provider to determine a more accurate diagnosis.

Urgent care bridges the gap between an injury that can’t wait for an appointment at the primary care physician and the life-threatening situation that calls for a trip to the emergency room. Built around patient convenience, urgent care clinics are often found with extended hours, and are sometimes even open on holidays. Although all clinics are different, you can sometimes find them where no appointment is necessary.

Some symptoms that can be treated at urgent care include:

- Fever without rash

- Minor trauma such as a common sprain

- Painful urination

- Persistent diarrhea

- Severe sore throat

- Vomiting

- Accidents and falls

- Sprains and strains

- Moderate back problems

- Breathing difficulties (i.e. mild to moderate asthma)

- Bleeding/cuts — not bleeding a lot but requiring stitches

- Diagnostic services, including X-rays and laboratory tests

- Eye irritation and redness

- Fever or flu

- Vomiting, diarrhea or dehydration

- Severe sore throat or cough

- Minor broken bones and fractures (i.e. fingers, toes)

- Urinary tract infections

Emergency Room Visits

According to the CDC (Centers for Disease Control and Prevention), “one in five Americans reports visiting an emergency room at least once in the past year.” Perhaps not surprisingly, the CDC points out that the most common reason for adults to visit the emergency room are injuries. This might explain why 35 percent of adult visits to the ER require x-rays.

Children, on the other hand, are more likely to make it to the emergency room as a result of cold symptoms. This is especially true in children under four years of age.

In general, an emergency condition is one that can permanently impair or endanger the life of an individual.

Some examples of most common conditions that require emergency medical care according to CDC include:

- Severe chest pain or difficulty breathing

- Compound fracture (bone protrudes through skin)

- Convulsions, seizures or loss of consciousness

- Fever in newborn (less than three months old)

- Heavy, uncontrollable bleeding

- Deep knife wounds or gunshot wounds

- Moderate to severe burns

- Severe abdominal pain

So when you’re sick or injured, deciding where to get care is the last thing you want to worry about. Understanding your options now will make decisions easier when you need care immediately.

by Mark Smiley | Nov 23, 2015 | Feature Story Middle Left

by Brian Zabroski

The holidays can be a stressful time, especially when it comes to the financial burden it places on families. I know I didn’t realize the cost of toys, clothes and gifts when I was a kid. I’m sure my kids don’t realize the cost either. The average family will spend $860 on the holidays. One of the tools available this year is GiftFund. It is a crowdfund app, which friends and family can use to contribute money toward gifts in a collaborative fashion. Have a holiday party, but don’t want to get stiffed by your co-workers? Want to know who has and has not contributed? Interested in launching a fund request for the high-altitude 100,000’ balloon ride on the edge of space from Neiman Marcus. It’s only $90,000, in case you’re wondering. This app may reduce the awkwardness of asking for money during the holidays.

I had mixed feelings the other day while watching Toddler App use the Target Kids Wish List app. At first I thought, “This is amazing!” He totally grasps the concept of scrolling through an app, selecting toys, adding them to a list and getting excited about what Santa may deliver. Then I thought, “This is terrible!” When I was his age, I used a Sharpie to circle items in the 3” thick Service Merchandise catalog. This kiddo, if he had access, could jump on my Amazon app and cause some serious damage to our bank account. Yikes. Don’t get any ideas! The “iGeneration” is getting scary good with technology.

Back to the app, Target Kids Wish List, it creates a gift registry. Yes, the idea of a gift registry for Christmas is bizarre to me, however it has been a huge help. Now, when he sees a toy commercial, he jumps on our phone to add the item to the list. Nearly our entire family is outside Colorado, so we’re able to share the registry, they can decide what to send without stepping over each other, and we reduce random calls during the day from family at the store asking what Toddler App wants for Christmas. In the past, the answer was easy, “Um … Everything!”

There is something so pure and enjoyable during the holidays, especially with children. People seem nicer. Well, maybe not in the Cherry Creek Mall parking lot, but everywhere else. There seems to be an extra smile or two throughout the day. During our very hectic business day, it is difficult to see the forest through the trees. Then you get home with the kids and they have such a different perspective on life. It’s refreshing.

During a recent visit to the mall, we noticed a long line for Santa, which was amazing considering it was NOVEMBER! The kids’ excitement was off the charts to see Santa. How cool! I thought, there must be a better use of our time than standing in a long Santa line. Shazam, Where Is Santa app, which allows you to book a scheduled appointment with Santa (First World Problem Solved!), as well as check on the line and viewing times. The only mall in Colorado subscribing to this service appears to be Colorado Mills, but the drive west may be shorter than waiting in that line elsewhere.

Well, here’s an idea for the non-millennial children in your family: Amazon Fire Tablet. Why? It’s only $50. They even offer a six-pack of Amazon Fires for the price of five (5), which is still less than one iPad! I do need to call something out on the Amazon Fire, it is not great by any means. For a Toddler App through Youth App age, it’s perfect. It is durable, clunky, lacks access to many of the “worrisome” apps (i.e. no YouTube, Instagram, Snapchat), but it is an alternative to a much more expensive tablet. At this price, it isn’t even worth buying the case ($25) since it is half the cost of the tablet. There, now you have a few extra dollars to put toward GiftFund for that balloon ride.

Recently, I saw an ad for a Blackberry mobile phone. Are they still in business? Is anyone not from Canada using this mobile device anymore? If you’re in the market to accessorize your new iPad with the Apple Pencil or Smart Keyboard, get it ordered as soon as you’re done reading this column. There is a four week wait thus far. On the flip side, you can always use your fingers like we’ve been doing all along. In case you didn’t see the announcement, Apple launched the iPad Pro. It has a nearly 13” screen, which is 3” larger than the previous version. Is it me or does it seem that Apple launches a new product every few months. When thinking of the new iPad, think of the Amazon Fire, but 500 times better.

The trend over the past year has been wearables, such as FitBit and Apple Watches. I believe that market is becoming mature at a rapid rate. There is a large quantity of alternative, affordable, quality wearables to the Apple Watch.

I believe the next trend will be the “Smart” home. There are plenty of devices on the market to monitor appliances, lighting, security and temperature in the home, but there is a trend toward home systems. The cost of entry is decreasing. Samsung launched SmartThings, which is a home monitoring system to control, monitor and secure your home. Their system (and, they’re not the only ones with this technology by the way) monitor your home for water leaks, control the lighting and appliances with motion sensors and outlet adapters, as well as connect to cameras. This allows us to reduce our energy consumption by turning off lights, lowering the temperature, in addition to reducing the risk of break-ins by turning on lights remotely, and gaining visibility on the property through remote cameras. It does create a smart home. If anyone has a smart home story, please share it for a follow column.

Don’t forget to track Santa on Christmas Eve through www.noradsanta.org or NORAD Tracks Santa app. Your tax dollars at work! Have a blessed holiday from the App Family.

Contact Brian at brian@brianzabroski .com, on Twitter @BrianZab or LinkedIn at www.linkedin.com/in/brianzab.

by Mark Smiley | Nov 2, 2015 | Feature Story Middle Left

Right On ’Que: Sizzling

Carve BBQ Opening In Glendale

New Eatery From Southern Concepts To Add Fire In Belly Of Valley’s Dining Crowd

So you’re looking for that next great eating odyssey. Food you crave that’s guaranteed to satisfy your hunger. A renegade wave of new eateries is opening in Glendale and Denver with Texas-size ambitions and creative swagger that’s turning the Valley into the next great dining destination and barbeque is just the beginning.

Carving out a laid-back local hot spot in Glendale is Southern Concepts Restaurants Group’s fast casual barbeque concept Carve Barbeque opening Nov. 5 in the 1000 S. Colorado Blvd. shopping plaza. To celebrate the opening Carve will donate 10 percent of all sales to the Denver Rescue Mission during grand opening day. In addition, the first 25 guests to arrive on grand opening day will receive free Carve for one year. It is the first barbeque eatery from the Colorado Springs-based group that owns and manages three ful l-service restaurants in the market. “Carve is different than your traditional pit barbeque restaurant — it is barbeque without boundaries,” explains Mitchell Roth, Southern Concept’s CEO. “We will be setting ourselves apart by choosing only the finest quality, all-natural meats.”

l-service restaurants in the market. “Carve is different than your traditional pit barbeque restaurant — it is barbeque without boundaries,” explains Mitchell Roth, Southern Concept’s CEO. “We will be setting ourselves apart by choosing only the finest quality, all-natural meats.”

Customers will walk down the food line in the contemporary eatery where they choose from four styles — naked, salad, sandwich or street taco — plus meat garnishments. The eatery will serve pork, chicken, brisket, ribs plus prime rib, all natural wood-smoked. The fresh sides will range from traditional options like coleslaw, to barbecue pico de gallo and charred corn salad. Craft brews and local wines will be available. Information: 303-756-3356.

Eatery Explosion

There are a multitude of new eateries open or scheduled to open as the holidays near. Newly opened in Glendale is Noodle Fresh offering Asian Street Tacos, Ramen bowls plus create-your-own noodle bowls. Information: 303-757-0145. Also now open is Telegraph Bistro & Bar in the Wash Park neighborhood at 295 S. Pennsylvania. It features a menu of seasonal New American cuisine em phasizing fresh seafood and vegetables. Information: 720-440-9846.

phasizing fresh seafood and vegetables. Information: 720-440-9846.

The Blue Island Oyster Bar — sister restaurant to Golden’s Table Mountain Inn eatery — has opened in Cherry Creek’s 250 Columbine project. Along with oysters from the restaurant’s own New York oyster farm, you can dine on lobster rolls, caviar, crudos, burgers, fresh fish, chowders and salads. Information: 303-333-2462.

Additional restaurants yet to open include Matsuhisa Cherry Creek, scheduled to open by year’s end in the Creek’s Steele Creek Apartment building; Del Frisco’s Grille — the casual sibling to Del Frisco’s — is opening a space in the new First Bank Building in Cherry Creek boasting a rooftop patio and an upscale bar. The menu will include prime-grade steaks, pristine seafood and two-fisted sandwiches and flatbreads. Finally, SOL Mexican Cocina is also opening in the 250 Columbine project. It will focus on the coastal cuisine of the Baja coast. The menu will range from various guacamoles to seafood dishes, street tacos, and bigger entree plates.