by Robert Davis

Residents in the Huntington Estates neighborhood are crying foul that two doctors are allowed to allow their property to continue to be in disrepair and neither the neighborhood covenants nor Arapahoe County can stop them.

“All of us are tired of looking at the dilapidated and unoccupied house,” Dick Pond, the treasurer of the neighborhood Home Owners Association, told the Glendale Cherry Creek Chronicle in an email. “The HOA and a few neighbors have tried to contact the Brauns about it, but we keep getting the same answer, that they’ll be selling it soon.”

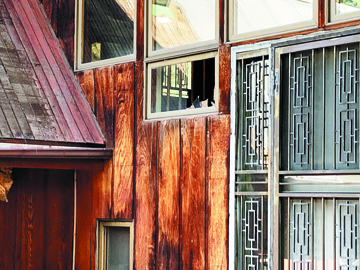

The owners, Tom and Carol Braun, left their house on East Evans Way 15 years ago after purchasing a bigger home on the other side of the neighborhood. Now, their old house sits on a plot of dead grass and overgrown shrubs. Bits of glass from the windows litter the yard.

Pond and other members of the HOA leadership team have tried to contact the Brauns on numerous occasions about the property. They’ve also sent letters to their new residence warning the Brauns that if they hold on to the property too long they might miss out on the wave of rising home values in the area.

“Values in the city and our local area are on the rise and several families in the neighborhood are trying to sell or will be soon,” one letter dated April 28, 2013 reads. “This could again be a lovely home, if only it were occupied and maintained. However, many solar panels are missing or broken, gutters are falling off or missing, and the front yard is dirt and weeds.”

The Brauns did not respond to repeated requests for comment for this story.

Power Of Association

State laws generally give HOAs vast powers to control the aesthetics of their neighborhood. Each county adopts their own laws regarding the powers of these associations as well.

However, those laws are only enforceable if the HOA is registered with the state. HOAs that make more than $5,000 per year are required to register with both the Department of Regulatory Agencies (DORA) and the Director of Real Estate (DRE). Those making less than $5,000 annually only register with the DRE and are not held to the same standards of reporting.

Huntington Estates’ HOA is informal, as resident Paul Hanley describes it. While this structure may benefit homeowners in that there are no monthly HOA dues to pay, it also makes it difficult to take decisive action against the Brauns.

“The covenant governing the neighborhood was written back in the 1960s, and it’s weak compared to today’s standards,” Hanley said. “But, this is what happens when you don’t live in a municipality. You may pay less in taxes, but you get less government in return.”

Residents have contacted Arapahoe County about the Brauns’ house many times, but the County’s answer is never simple. Since Huntington Estates is located in unincorporated Arapahoe County, local ordinances don’t carry much weight. Instead, the county relies on the principles of fairness to adjudicate disputes among neighbors.

“They’ve basically told us that because the farmers and ranchers nearby can allow barns and other structures on their property to dilapidate, then so can homeowners in Huntington Estates,” Hanley said.

Hanley also admitted that some residents had discussed attempting to strengthen Huntington Estate’s covenants, but doing so requires a unanimous vote among homeowners.

“It would really just be more trouble than it’s worth,” Hanley said.

Living Trust

According to Arapahoe County property tax records, the Brauns’ house is currently owned by a living trust in Carol’s name. Typically, wealthy homeowners put property into living trusts if they plan on passing it on after death.

Some residents worry that there may be a financial incentive for the Brauns to let their property dilapidate, and that this incentive could negatively affect their home values.

“Many neighbors have expressed concern about your disregard for the condition of the abandoned house and about the market values of their own properties as a result,” the HOA letter reads. “In addition, the community is concerned about any potential health or environmental impact as a result of the continued declining condition and lack of care for the property.”

Colorado is one of 38 states that doesn’t charge an estate tax. Even so homeowners can still be charged a federal estate tax after their death. Under prime circumstances, married couples can protect up to $22.28 million under the federal exemption guidelines. A single homeowner can protect an estate valuing up to $11.18 million, according to the IRS.

By allowing their home to dilapidate, the Brauns could avoid paying estate taxes all together. They currently own two homes, one of which was purchased for just under $600,000 while the median home value of the neighborhood is close to a half-million. Factor in a few savvy investments and they could be leaving behind a nice nest egg with no tax burden.

However, the majority of the neighbors just want the problem to go away. They’re tired of seeing the home slowly crumble while homes that are near it have had a tough time staying full.

“This is really a case of buyer beware,” Hanley said. “We’re basically subject to the goodwill of our neighbors on this one.”