“Repeat after me: real estate provides the highest returns, the greatest values and the least risk.” — Armstrong Williams, entrepreneur

by Luke Schmaltz

As of February 25, 2020 — according to Forbes and WalletHub — Colorado had one of the lowest residential property tax rates in the nation — just 7.15% — third to only Hawaii and Alabama.

As of November 3, 2020 — according to some fiscal experts — that glowing statistic may gradually begin to fade.

An Uneven Keel

Consistent with the year’s underlying theme of division and disparity, the commercial tax rate sits at an inverse position at 29% — making the terrain for independent, small businesses especially rough, and increasingly so as Covid-19 looms on. Before the election and the ensuing repeal of the Gallagher Amendment, anyone keen on owning a home, as well as commercial property in Denver, was privy to staggeringly different tax bills — even if their residential property was right next door to that of their business.

In an election that was overwhelmingly characterized by close races and slim margins, Amendment B (repealing Gallagher) passed in a landslide vote of 57.4% to 42.6%. This means that the low property tax rates Colorado homeowners have enjoyed for decades will, according to opponents of the measure, begin to increase the tax burden homeowners are forced to bear — especially those in the urban middle-class sector.

Wide Appeal

For the uninformed, property taxes are collected in order to pay for local government services that benefit the immediate district. These include schools, fire departments, infrastructure, water, libraries, recreation and county road maintenance.

As all property owners quickly discover — residential and commercial alike — taxes are determined by complex formulas, dreaded by many and resented by all for their unrelenting consistency. In this election cycle, the convoluted nature of taxes seemed to have influenced the diverse interest in Amendment B vs. the Gallagher Amendment — perhaps the only refreshing thing about the issue in general.

Amendment B garnered a patchwork of varied bipartisan support, both for and against the measure. Proponents included former U.S. Senator Hank Brown (R), current Republican state senators Bob Rankin of Carbondale, and Don Coram of Montrose, current House Representative Daneya Esgar (D) and former Colorado Secretary of State Bernie Beusher (D). Naturally, the measure was opposed by the author of the Gallagher Amendment, former Senator and career public servant Dennis Gallagher (D) along with the right-leaning head of Colorado Rising Action, Michael Fields, as well as with former House Speaker Dickey Hullinghorst (D).

An Outdated Formula?

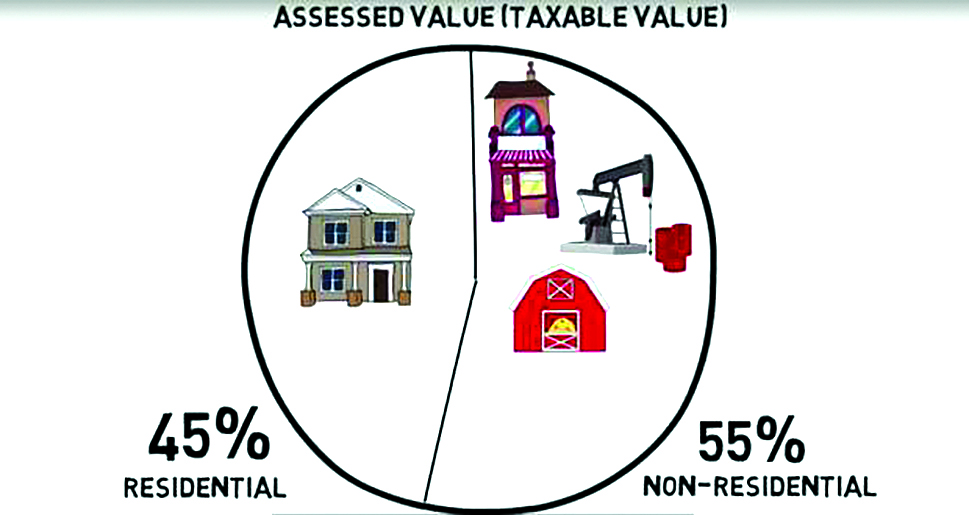

For nearly four decades, Colorado residential property owners have enjoyed consistent tax cuts supplied by the Gallagher Amendment which, until November 3, had rates locked in at 7.15%. The disparity here is stark, however, as commercial property owners were “stuck with the bill” as it were and foisted with tax rates consistently ringing in around 29%. Under Gallagher, residential taxes could only allot for 45% of the total tax base, with nonresidential properties such as retail businesses, factories and farmland making up the remaining 55%. As rising residential property values skyrocketed, the inherent complexity of the tax formula resulted in an unbalanced scale — with the heavy end tipping toward commercial property holders.

While this lopsided provision was great for homeowners in high-growth areas along the front range, owners in rural areas suffered — as their property values were not accruing at nearly the rate of their urban counterparts. Simply put, with Gallagher in place, the more the value of a property increased, the less percentage of tax the owner had to pay. With this protection removed by Amendment B, critics of the measure are predicting that residential property taxes will rise drastically. Meanwhile, supporters of the measure contend that removal of the Gallagher Amendment will leave current rates frozen in place — for now.

Too Much Too Soon?

The recently-televised Colorado Decides: Amendment B debate hosted by PBS 12 featured outspoken public figures weighing in on both sides. Representative Esgar (D) championed the effect a repeal would have on small businesses: “ … right now 20% of the taxpayer base (commercial property owners) are paying 55% of the tax [revenue]. These are small businesses … right now they are being hit the hardest … they want to know, right now, why they are paying four times what [the] residential property tax rate is …” Esgar explained further that leaving the Gallagher Amendment in place would result in commercial property taxes ballooning to up to five times that of the residential rates.

Meanwhile, in opposition to Amendment B, Michael Fields (Colorado Rising Action) explained that a statewide repeal is far too drastic, and rather, measures should be taken to amend the tax code in certain districts who are suffering from loss of revenue. In the aforementioned televised debate, Fields contents that: “ … a solution needs to be more regionally based or county based … I think that makes a lot more sense because there are areas of our state that are either less commercial property or their (residential) values aren’t going up as much …overall, this is a regional problem and there should be a regional solution.

Upwardly Mobile

As fate would have it, the Gallagher Amendment is no more. Without another policy in place, according to TABOR, residential property taxes will rise as the property values increase. So, as Denver renters have recently seen in vivid detail, this could mean yet another rent hike as landlords pass the overall cost of owning property onto their tenants.

While proponents of Amendment B downplay the severity of repealing the Gallagher Amendment, others like Fields are quick to point out the costly implications. An October 26, 2020, article published on coloradopolitics.com contends that a repeal leaves no protections in place for property owners. This means that — as required by TABOR — property taxes would increase to the tune of $203+ million and keep climbing — a fact that lawmakers like Daneya Esgar seem to have forgotten to disclose whilst selling this new piece of legislation to an uneducated and most likely distracted public.

Others contend that tax rates that are applied according to the rapid rise of property values, while being inconvenient for owners, can spell ample funds for public services — especially in rural and economically challenged areas. At any rate, the varied implications of how things may play out are a fitting reflection of the complex nature of property tax formulas. To find out what the repeal truly means (just like everything else this year) folks are going to have to just wait and see.