Units Built This Year Rank Mile High City 10th In Nation; New Units Expected To Jump Vacancy Rate To More Than 9%

by Glen Richardson

Suburban Style: New Edera Apartments on the old Kmart site at S. Monaco Parkway and Evans features open courtyards and gardens.

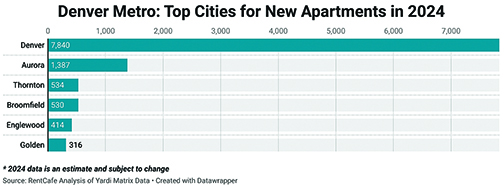

Denver is experiencing a construction boom for apartments, with the second quarter of the year seeing a record 7,349 new units completed. Metro Denver is expected to deliver 13,000 new units by the end of 2024, ranking the city 10th in the nation. Nationwide, the U.S. surpassed 500,000 units for the first time on record.

The latest city construction is part of a larger trend of 19,000 new units added to the market over the previous 12 months, and 31,235 units in the last two years. This is the strongest multifamily construction surge in the region since the 1970s.

However, the Census Bureau now predicts new housing units in the Mile High City will drop by 18% in 2024, to a

Canyon-Cut Crash Pad: The 16-story, 187-unit One River North features soaring walls enchased in a one-of-its-kind sculptural facade.

total of 17,000 units, down from 20,600 in 2023. The shift is due to a number of factors, including higher interest rates, labor shortages, plus a scarcity of lots.

Vacancies Soar

New units are expected to increase Denver’s vacancy rate to more than 9% by the end of the year, which would be the highest it’s been in over 20 years. The luxury four- and five-star segments make up almost 80% of the units scheduled for completion in 2024, and these properties are expected to be most affected by the new supply.

new supply.

Denver’s robust pipeline of around 28,000 units under construction will maintain pressure on occupancy rates, though potential relief may emerge in 2025. The significant decrease in new apartment construction starts, however, could lead to an increase in rent growth.

Denver’s economic outlook for 2024 suggests tempered growth, with a 0.4% job growth rate, supported by sectors like education and health services, but challenged by contractions in financial and professional services.

Rent Growth Slows

The median rent in Denver fell by 0.1% through July, and has now decreased by a total of 1.4% over the last 12 months. The city’s rent growth over the past year is similar to both the state (-0.9%) and the national average (-0.8%).

Denver’s rent growth in 2024 is pacing below last year. Eight months into the year, rents rose by 2.6%. This is a slower rate of growth compared to what the city was experiencing at this point last year: From January to August 2023 rents had increased 3.9%.

Denver rents went down 0.5% in August, compared to the national rate of 0.1%. Among the nation’s 100 largest cities, this ranks Denver 86th. That is similar to the monthly rent growth in Louisville, KY (-0.1%), and Jacksonville, FL (-0.5%).

Rents 26% Higher

The median rent across the nation as a whole is $1,241 for a 1-bedroom, $1,398 for a 2-bedroom, and $1,412 overall. The median rent in Denver is 26.1% higher than the national average, and is closer to the prices in Vir

AMI Apartments: Opening at the old CDOT headquarters on E. Arkansas Ave., limited income Krisana Apartments will have 151-units.

ginia Beach, VA ($1,785), and Long Beach, CA ($1,785).

The rent price in Denver proper is $1,781, or 1.2% lower than the price across the metro as a whole at $1,802.

Of the 18 cities within the Denver metro area, Highlands Ranch is currently the most expensive, with a median of $2,422. Englewood is metro’s most affordable, with a median of $1,547. Metro’s fastest annual rent growth is occurring in Northglenn at 3.1%, while Golden is the slowest at -3.9%.

Gems At Year’s End

With the pipeline of new apartments at a record high, there are a variety of locations, styles, and types of units coming onto the market as 2024 ends. Here’s a look at some of the top projects nearing or just completed in city neighborhoods.

One such gem nearing completion is the Akin Golden Triangle on Bannock St. The 12-story building with 98 multi-family units, honors the Golden Triangle Arts District design guidelines, while taking a fresh approach to the built forms within. The result is a project that enhances the environment and elevates Denver’s urban apartment living experience. Dissimilar, but also unique is One River North, a 16-story, 187-unit Highrise in the RiNo arts district. It features private, open-air terraces and soaring walls enchased in a first-of-its-kind sculptural facade.

For renters seeking a more suburban lifestyle, there is the newly opened Edera Apartments featuring open courtyards and gardens. Built on the site of the old Kmart at S. Monaco Parkway and Evans Ave., there are a total of 287 units, ranging from studios to three-bedroom units. Also less urban is Avanti Residential in the Sloan’s Lake Neighborhood at West 29th Ave. & Xavier St. It also has studios to three bedrooms, allowing renters to enjoy walks and scenic bike rides. For those with limited incomes (60% of the Area Median Income or AMI), Krisana Apartments — a 151-unit, four-story apartment complex — is about to open on the site of the old CDOT headquarters at 4242 E. Arkansas Ave. Project features 21 studios, 71 one-bedrooms, and 59 two-bedroom units. A King Soopers Market will open next to Krisana on the west in 2025.

Bannock Buildout: Following Golden Triangle Art District guidelines, the 12-story, 97-unit Akin Golden Triangle is expected to open by year’s end.

Construction Stalling

The apartment building frenzy of the past two years won’t continue through 2028. Metro Denver is projected to lose its 2019-2023 pace by 7.8%, Thus, about 46,629 new units are expected to open in the following five years.

Compared to the previous five-year period, the Mile High City will see a 17.3% decrease in new units, with 23,421 expected between 2024-2028.

In contrast, Aurora is expected to add 95.6% new units, doubling the number of apartments added in the last five years (from 4,611 to approximately 9,018 units).