Paradise Baggage

One School Turned The Corner And Soared: Can Other Schools Learn And Follow?

Team Meeting: In the library, Principal Sheldon Reynolds, Meg Emrick, Sarah Ronoh and a representative from DPS’s Imaginarium plan how they will measure and observe the process called Distributive Learning, where students own their learning process. As a perfect example of Distributive Leadership, Reynolds says little, giving Emrick and Ronoh space to guide the discussion.

by Ruthy Wexler

When in December 2017, Principal Sheldon Reynolds heard that Greenlee Elementary, the school he’d been reviving for just 18 months, might be closed — over test scores that hadn’t climbed fast enough — he was not happy. How Reynolds turned this scenario around — reinventing the school according to Denver Public School’s (DPS) requirements, then transforming it according it to his original vision so successfully that families outside the neighborhood now choose it — is a balancing act worth studying. How did he succeed where so many have failed? And what is the recipe, so others can follow?

It Ain’t Me, Babe

Asking Reynolds those questions will not get a straight answer.

Praised for the happily humming classrooms at what is now Center for Talent Development at Greenlee (CTD), Reynolds says, “It’s not me. It’s the teachers doing that.”

Asked the secret of putting a failing school on the road to success, Reynolds says, “When I came, there was a ton of talent already here. We just identified those talents.”

This was Reynolds’ original vision: seeing an underperforming school as filled with “gifts and talents.” What’s new is what he’s done with that vision.

Introspection

“When DPS slated Greenlee for closure, I thought it was the worst thing ever,” Reynolds recalls. “But it ended up being the best thing. Because it made us come up with our model.”

Reynolds did “a lot of soul searching” before he wrote a plan that would get him back in charge of Greenlee. He’d given it his best shot. What was missing? Brainstorming with staff, the model that finally was

Learn from the Best: Sarah Ronoh is both a parent and staff member at CTD. “We’re all in a constant state of learning,” says Ronoh, whose job it is to study the “best practices” teachers come up with and share what works. A teacher, Ronoh wanted to go into administration and asked Reynolds for a job, so she would work with him and learn leadership “from the best.”

one that fleshed out the “gifted and talented” vision with lots of structure.

“The idea,” says Reynolds now, “is only as good as how you implement that idea.”

Use Every Resource

Once CTD was a go, Reynolds reached out to departments inside DPS — like Tiered Support, which agreed to grant money; Gifted and Talented and the Imaginarium. Soon, a partnership was formed.

“Those departments all got together,” recalls Sarah Ronoh, a Greenlee parent who became CDT’s Innovation and Implementation Partner, “and said [to Reynolds], ‘Hey! We’re super curious about what you are doing. We want to study it!”

Ronoh now works with those departments to observe the changes staff puts in place and measure the results.

Freedom And Trust

Meg Emrick, who’d been teaching at Greenlee for five years when Reynolds arrived, already thought the kids had “terrific talents. Sheldon gave us the freedom to figure out how to make those talents come alive.

“We were encouraged to take risks. To think outside the box. Sheldon trusted us. That freedom and trust made us feel valued and needed,” concludes Emrick, who went from classroom teacher to Senior Team Lead to her present position as Dean of Instruction — a “perfect example,” says Reynolds, of “tapping staff talent and watching them grow.”

Research

A little while back, Reynolds told every teacher, “The first 15 m

Enthusiastic: While on lunch duty, Principal Sheldon Reynolds helps a boy put air into his ball. It’s a telling image. The phenomenon of how Reynolds manages to enroll an entire school in his vision, get students and staff to work harder and more enthusiastically than ever before — all the while empowering others and claiming less power for himself — is the heart of CTD’s success.

inutes of every day, I want you to teach your students how to use tools here in the school.”

“That’s all he said,” notes Ronoh, who for “weeks and weeks, went to each classroom and wrote down what each teacher did with this assignment. Then Sheldon and I got together, looked at what got that idea of tools across — then shared it out to staff.”

Reynolds points to three banners: Use Tools Strategically. Construct Informed Arguments. Connect Learning. “These are the habits we want for our kids. We are learning about learning. We’ve just scratched the surface.

“Now we are taking time to measure how well [new ideas] work.

“Design research … another shift for me. Before, I would roll an idea out to the whole staff. Now, I have a couple of things cookin’ in the lab, people working on them. When we finally roll ‘em out, I’ve already had user feedback.”

Leadership

“Sheldon doesn’t stand up there and tell us what to do,” Ronoh observes. “He says his vision. Then he distributes leadership. He completely trusts me to do what I do, completely trusts Meg …”

That works so well that “Sheldon can leave the building, for a day, a week, however long he needs, and things will still be up and running.”

What makes him that kind of leader?

“He has somehow,” Ronoh says, “gotten to this place where he knows empowering people, having faith in them, brings out the best.”

“How did you get to that place?” a visitor asks Reynolds.

After he lists a bunch of influences, Reynolds says, “Basically, it boils down to, most situations are what they are. The only things you can control is how you react. Which is why I push … my teachers and students to recognize they have agency in almost every situation.”

Success

The 2017-2018 test scores showed that this school — classified by DPS as “red” (failing) for years before Reynolds came — turned “green” (meets expectations) on their academic gaps indicator and are “green” in almost every growth indicator.

Reynolds points to all the help he’s received. As an Innovation School, CTD is free to experiment. Tiered Support gives extra money.

“The vision is starting to become the reality,” he admits. “It’s a good place to work now.”

They are studying how CTD got to this outcome, Ronoh says, “so hopefully, they can duplicate it somewhere else.”

“Research. Distributive Leadership. We have to figure out all the components. But what we really need to do is clone Sheldon.”

Troubling Time For Train Trips As RTD’s Rapid Transit Is Far From Fast

Travel Times Are Longer Than The Same Trip By Bus; Usually Uber, Lyft, Bike, Scooter And An App Are Faster

by Glen Richardson

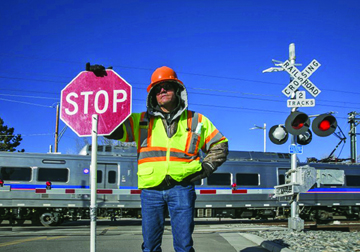

Train To Plane Pain: The 22.8-mile spur from downtown to DIA was expected to speed regional airport travel. Plagued by software problems, however, flaggers keep returning to crossings along the A Line between Union Station and DIA.

Tracking Trouble: As train problems increased RTD has resorted to flying drones to keep light rail systems in reliable motion. The aerial machines monitor the conditions of rail tracks and alignments.

“Less traffic congestion and more commuting options will improve the region’s quality of life and make Denver that much more attractive to residents and businesses,” declared then RTD Chief Cal Marsella at Rapid Transit’s 2006 launch.

Denver’s light rails trains, however, keep getting off track or making switchbacks — train lingo for reversing directions.

In the dozen years since Denver sent its neighborhoods down the transit tracks, the endless headlines haven’t been affable. Consider just a few from the last 10 months:

- Disruptions Delay Airport Travel – Feb.;

- Two Men Rob, Fatally Shoot Man At RTD Rail Station – March;

- The A Line Stuck For Hours Friday – April;

- Riders On Several Denver Light Rail Routes Run Into Long Delays – Aug.;

- RTD To Close 4 Downtown Light Rail Lines For 10 Days – Sept.; and

- Pedestrian Hit By Train In The Baker Neighborhood Has Died – Oct.

Rail Squeal

The speed myth is that rail transit is rapid transit. When the time needed for station access, transfer, waiting, and delays are taken into account, local riders insinuate that by and large, “rail travel times are longer than the time required for the same trip by bus.”

Moreover, business travelers are discovering the same thing: “Overall, not a bad ride,” declared Phil, a New York businessman. But he’s quick to add, “If you are not in a rush and know where you are going. Yet, I coughed up the cash for a taxi to bring me back to my hotel as it was way quicker and more convenient since I had a flight to catch.”

In addition to the speed concern, light rail ridership is increasingly being tied to competing alternatives. “If you have a car, a bike or a scooter on an app in your hand, and it’s right there, why not use that?” asks Jeff, who admits to being an area yuppie. His point: “You don’t have the indignity of being stuck at an RTD Park-N-Ride or on the side of the road for a bus that never comes.”

Riders Slump, Rates Jump

RTD’s rail service in Denver includes eight light rail lines plus two commuter rail lines. Light rail serves downtown Denver from the west (W Line), southwest (C and D Lines, along US 85), and southeast (E, F, and H Lines, along the I-25 corridor). Most light rail lines operate every 15 minutes or less throughout the day, including evenings and weekends. Light rail lines serve either Union Station or 16th & California-Stout Stations at either end of downtown Denver.

Transit ridership fell in 31 of 35 major metropolitan areas in the U.S. last year, including less than expected in Denver. As ridership slumps, rates will jump in Denver. With fewer riders than expected, RTD is raising the rates charged passengers effective January 1. A one-way ride from DIA on the A Line jumps from $9 to $10.50. Local fares increase to $3, up 40-cents and regional fares go up 75-cents to $5.25.

Denver averaged 67,500 weekday boardings last year, ranking the city seventh behind both Portland and San Diego. As a contrast reference, San Francisco’s Embarcadero averages 162,500-weekday boardings.

Commuter Rail Venture

The A and B Lines along with the G Line when it eventually opens, are RTD’s first foray in commuter rail. The trains are much heavier and go faster than the agency’s light rail — up to 79 mph. The lines are being built and operated by a private consortium known as Denver Transit Operators. The Transit Operators and their subcontractors are all under contract to RTD.

RTD has trumpeted the A and B Lines for being the first commuter rail lines in the country to integrate a PTC system (Positive Train Control) into its construction. The system, however, has had a shaky start, including with the PTC-controlled wireless crossing gates that have constantly led to flaggers being stationed at grade crossings. Insinuations have been made that the malfunctioning PTC system may be due to a bad design of the A Line itself.

The Federal Railroad Administration (FRA) requires a minimum warning time of 20 seconds before a train enters the crossing. The A Line timi ng is often a great deal beyond the requirement. This is the foremost reason why the planned RTD G Line is delayed.

ng is often a great deal beyond the requirement. This is the foremost reason why the planned RTD G Line is delayed.

Delays, Lawsuit

Metro leaders in Denver’s north and western suburbs have constantly complained because of the delays associated with the rail lines promised in the 2005 FasTracks vote. RTD initially set an opening of this year (2018) when construction began on the North line four years ago. The 13-mile line will carry passengers between Northglenn and downtown’s Union Station.

RTD now estimates its future northern suburb commuter rail line won’t open until the spring of 2020, a delay of approximately six months beyond the estimate made last year of late 2019. Northglenn’s Mayor Carol Dodge isn’t surprised by the most recent delay. “We figured it was going to be 2020, because they really haven’t kept their promises on many of the openings.”

Delays and other problems with Denver’s A Line have resulted in a September lawsuit against RTD by Denver Transit Partners. The suit accuses RTD of “breach of contract, violation of the covenant of good faith and fair dealing” and seeks “declaratory relief against the district’s refusal to accept changes in law and unforeseeable circumstances,” according to Waukesha, Wis.-based Trains Magazine. The magazine article quotes The Denver Post as saying the group of private companies are suing RTD for “tens of millions of dollars.”

Management Matters

Critics suggest many of RTD’s problems are a result of “train operations and management.” They related Denver’s problem to the procedures and related equipment enabling a coherent operation of the different structural subsystem, both during normal and degraded operation. In particular they refer to train driving, traffic planning and management.

In March CPR News reported incidents of speeding, blown red signals and even derailments in the maintenance yard. Interviews by CPR’s Nathaniel Minor with former and current engineers cited “a constant push to remain on time, tired operators and low wages that contribute to high employee turnover and, subsequently inexperienced engineers.”

The broadcast came shortly after RTD named Michael Ford its new chief operating officer in February. In the new position created by the agency, Ford is to “work with train operators, mechanics, and support staff to ensure the agency’s operations are reliable, safe and clean.”

Beauty & The Beast: Denver’s Union Station is an architectural marvel. All RTD needs to do now is solve its operational issues and get trains operating on time without delays.

Guest Editorial

DeGette Announces Run for Democratic Whip

By Congresswoman Diane DeGette

I am running to serve our caucus as Democratic Whip and hope to count on your support.

I am running to serve our caucus as Democratic Whip and hope to count on your support.

Thanks to your tireless work and the energy and enthusiasm of Democratic voters across the country, we will enter the 116th Congress with a Democratic House majority for the first time in eight years. This will be an awesome responsibility as we fight to deliver on the promise of bold action for the American people – even while Republicans continue to hold the Senate and the White House. In this tough environment, I am confident my years of whipping experience will help us win the key floor votes that we will need to advance our agenda.

Success for House Democrats in the coming years will require strong unity to stand for our core shared values, while appreciating we only reach that unity by understanding the perspective of every member and his or her district. The Whip must empower each member of our caucus to serve as a full partner, bringing his or her energy, passion, and expertise together with others’ to meet our common goals. It will also require the institutional knowledge and legislative savvy to go toe-to-toe with Senate Republicans and the White House.

Having served for seven congresses as Chief Deputy Whip, I have a strong track record as an effective strategist, precise vote counter, and experienced, bipartisan negotiator. I have passed major bipartisan bills, like the 21st Century Cures Act, rallied Republicans to support ethical stem cell research, forged agreements in our caucus on the Affordable Care Act, and held Democrats together on close energy and environmental votes. For nearly two decades as co-chair of the Pro-Choice Caucus, I have whipped countless tough votes in an effort to successfully stop the Republicans’ radical anti-choice agenda. You can count on me to deliver for our caucus.

We also must do more to ensure our leadership reflects the diversity of the caucus and our constituents. Eighteen years ago, our caucus voted to elevate a woman to the top levels of leadership, and it is past time for us to do so again—I would be only the second woman to hold this post. I would also be the first Whip from the Mountain West, and our path to a lasting majority must include broadening the caucus’ geographic appeal.

As Whip, I will reinvigorate all aspects of the current operation to ensure we draw upon the full potential of our members. This means bolstering the existing operation to more deeply involve bill sponsors, issue experts, and committee chairs and members when a bill moves to the House floor. It also means partnering with our messaging arm, so that our work resonates throughout the country and shows the American people that our actions can live up to our words.

I will continue to campaign on behalf of Democratic candidates across the country, from the most vulnerable incumbents to promising new challengers. I also understand the responsibility the Whip has to raise the money necessary to communicate effectively. I have raised millions for candidates and the DCCC, and I was on the host committee for the 2008 Democratic National Convention in Denver, which raised more than $60 million.

This is an important moment for our caucus to move smartly on behalf of the American people. Together, we can protect American values and enact positive change for the country that rallies the public to our cause. I look forward to discussing how I can work with you as Democratic Whip during this effort.