In the past year, the Denver commercial property market has been flipped upside down, run through the wringer, and hung out to dry. While circumstances appear bleak in some areas, the twists and turns of pandemic-induced social upheaval are not without glimmers of hope and outright indications of future solvency.

Commercial and residential real estate are symbiotic halves of a larger whole, and just as one directly affects the other, the balance between the two can take on surprising configurations. Such is the current state of affairs in the Mile-High City, and property professionals from both sides of the fence are forging forth with equal amounts of bullish determination, speculative flexibility and hopeful trepidation.

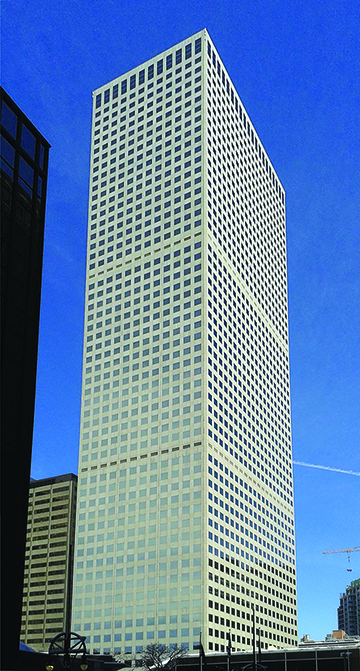

Downtown offices may not quickly repopulate, as many work-from-home folks have relocated to the suburbs.

Parallel Perceptions

From the viewpoint of residential real estate professionals, the commercial market is a cliffhanger, a head-scratcher, and an anomaly compelling enough to draw curiosity that is far beyond casual observation. Jennifer Barnes of eXp Realty, LLC has considerable experience in the residential sector, and has watched with piqued interest as her area of the market reacts to the changing commercial sector. This area of the market is inevitably affected by the overnight replacement of traditional office settings with entire industries of remote workers. “The draw to being in the city is gone,” she begins. “There has been a huge run [on residential properties] across the whole Front Range — especially places like Conifer, Evergreen, and Elizabeth,” she explains. “The whole downtown Denver market is not what it was — people are not clamoring to be down there right now because they are working remotely. I mean, why would you want to live in a congested area if you don’t have to?” Barnes was fortunate enough to be on the upside of the remote worker trend, unlike other large real estate firms with huge offices and sizable leases to boot. Her firm, eXp, grew during the pandemic due to low overhead while others were forced to downsize because “they didn’t have the revenue from home sales because they were shut down during Covid, but they still had huge office building leases to pay.”

Meanwhile, from a real estate inspector’s viewpoint, the commercial property shift has created circumstances reminiscent of the pre-marijuana retail boom. Robert Crawford is owner/operator of Colorado Complete Home Inspections, and he points out, “Before we had the cannabis industry, we actually had a lot of empty warehouses and empty retail spaces. Then, something came along which allowed new investors to buy up the available spaces at a fraction of the price. The vacuum left behind by the Covid reminds me of that. The landscape now versus back then bears a striking similarity,” Crawford explains. “You’re seeing ‘for sale’ and ‘for lease’ signs on retail spaces in some districts and among commercial warehouses alike.” So, it seems the stage is once again set to favor a buyer’s market. Perhaps this indicates that once again, another influx of outside investment capital and enterprise is already underway.

A Dual Perspective

Shane Henry of 303 Property is amazed at how many cash-solvent investors are standing by to scoop up retail spaces.

Shane Henry, owner of 303 Property, has been working as a broker in the Denver commercial and residential markets for eight years. “When Covid hit, I thought commercial real estate was going to totally take a dive, but it didn’t,’’ he begins. “There’s still a lot of people out there with money, so as soon as a retail space becomes available, someone else is waiting to swoop in and scoop it up. So, it’s really interesting because I thought for sure it was going to be the opposite. It blows my mind, to be honest.” Henry continues, “A lot of people are showing up from other states like California with a lot of money from having just sold property there. So, they can come in and pay cash for spaces in Colorado.” Case in point: strip malls. Henry explains the robust state of occupancy in most of these retail destinations, “I’m not seeing lots of vacancies in them. If anything, I’m seeing almost more of a demand for these spaces.”

Letters From The Front

Meanwhile, a cross-section of those working exclusively in the trenches of Denver commercial real estate reveals a wide variety of viewpoints.

-

Vincent Grandi with Keller Williams Realty Urban Elite thinks vacant commercial properties offer some obvious social solutions.

Vincent Grandi of Keller Williams Realty Urban Elite contends that the work-from-home directive has gained momentum that may not be totally reversed. He sees the vacancies in the office building sector of the commercial market as an opening to address the 500 lb. elephant in the proverbial room. “This could be an opportunity to address the homeless crisis with a windfall of micro-type condos” he explains. While this is merely speculation and not a hard-and-fast solution, Grandi is also quick to point out the consequences of office buildings and warehouse properties which remain empty for too long. “Leaving all that property vacant is just presenting opportunities for things that aren’t good such as graffiti, arson, vandalism, and theft.”

- Mark Ryan, a broker with eXp Commercial Real Estate, lays it out plain and simple with the office building situation. “The biggest eye opener for me was how people working from home had such an effect on property values. Commercial property shifted from a landlord’s market to a tenant’s market overnight,” he begins. “What I’m seeing is a whole lot of properties coming on as ‘reduced rate’ listings.” While this is the case with office buildings due to the rigid nature of their intended use, it may not apply to other commercial properties. “Retail is different, because it can be sliced up in so many different ways,” Ryan explains.

-

Michael Griffin of Madison Commercial Properties feels that office building occupancy will return as a fiscal necessity.

Michael Griffin is a Managing Partner at Madison Commercial Properties in Cherry Creek, and he sees the effect of the work-from-home contingency on office space as a temporary circumstance that will correct itself. “Over time,” he attests, “people will be getting back to work [in offices]. Yes, Covid affected office space, for sure, but the last six weeks have been really busy,” he explains. “For some industries, office dynamics and corporate culture rely heavily on in-person workplace environments. As a business owner, I know for a fact that it is crucial to directing, motivating and communicating with your staff.”

- Yvette Kimmel is a broker with Ai3 Properties, which handles a network of 10 office buildings in Southeast Denver. She paints an upbeat picture of the commercial real estate market, at least as far as her properties are concerned. “We have every reason to be encouraged” she begins. “We have been extremely busy, and the only thing that is different in our business is that our tenants are just kind of moving around. In some cases, it is to smaller suites … but for the most part, we are staying very full,” she explains. “I think we are in an enviable position because we are not in prime downtown real estate, and we are not in prime DTC real estate — we’re right between those, so we’ve got people moving out of those expensive suites into something that is still in a prime location without those high prices per square foot,” she continues. Kimmel is confident that office culture is an integral part of American work life, saying, “Part of the experience is the social experience.” Kimmel also contends that, as society opens back up, in-person retail may also be in for a much-needed surge. “We don’t all want to be buying from Amazon for the rest of our lives,” she says.

-

Rachel Colorosa of Colorosa Commercial Properties takes a data-driven approach to her informed speculations.

Rachel Colorosa, Executive Director of Colorosa Commercial Properties, is a self- professed “statistics geek” and a graduate of Colorado College with a B.A. in International Political Economics. When analyzing the effect of Covid-19, the work-from-home contingency and the stark vacancies in large commercial office buildings — she dug into the numbers. She cites a series of recent surveys by Gensler — a global (50 locations worldwide) architecture, design, and planning firm focused on data-driven insights. “The data shows that, because of Covid and social distancing, people don’t like confined spaces — especially elevators,” she begins. “This means large downtown office buildings may not recover, but suburban office facilities under four stories will be at capacity.” Colorosa sees the current trends in retail, office, and industrial real estate as three intersecting lines which form an “x” with a horizontal line through it. “There’s a negative trend in retail, office is flatlining, and industrial is going way, way up,” she explains. Based on the Gensler data, Colorosa feels “we’ll see a lot of retail turned into offices” and “empty big box retail spaces will be repurposed as call centers or Amazon fulfillment centers.”

Currently, diagnosing the status of commercial real estate in Denver is speculative, and relies heavily on the informed perception of the beholder. At least one thing is clear — things are happening — which is a welcome change from last year’s grim alternative.