Carthel Joins Chronicle Team

by Mark Smiley

The Glendale Cherry Creek Chronicle welcomed its newest member of their team of reporters, 22-year-old Glendale resident Megan Carthel. Carthel moved to Glendale last August from Texas, and has been reporting on local stories for the Chronicle since October. Her stories, including “Hal Weber Makes Kids’ Birthdays Special” and “Tiny Houses Pull Into The Valley,” have sparked a positive response from the community.

The Glendale Cherry Creek Chronicle welcomed its newest member of their team of reporters, 22-year-old Glendale resident Megan Carthel. Carthel moved to Glendale last August from Texas, and has been reporting on local stories for the Chronicle since October. Her stories, including “Hal Weber Makes Kids’ Birthdays Special” and “Tiny Houses Pull Into The Valley,” have sparked a positive response from the community.

Carthel decided to move to Colorado because she needed a change. “I moved to the state after skiing in Colorado and I enjoyed my experience immensely,” said Carthel. “Denver reminded me of Austin, Texas.” She chose Glendale because it had affordable apartments to rent, was centrally located, and filled with younger people.

Carthel graduated from Texas State University-San Marcos with a B.A. in Electronic Media and a Political Science minor. As far as politics goes, she is more interested in the theory of politics. She believes that modern day politics is a PR stunt and theatrical.

Carthel has enjoyed numerous internships and other experience throughout her young career. Most of her experience was in Texas working as a sports marketing intern, news reporter, and even as a member of the Wings Team for Red Bull promotions.

Carthel was born and raised in Lubbock, Texas, and has many friends and family back home. Her passion for writing sparked early. She always wrote stories as a young girl. “I used to write these horrible stories as a child, but that’s where my passion for writing started,” said Carthel. “In college it developed into journalistic writing as I became more aware of the world around me.”

Now, she gets to write for a living. Carthel loves to work with and meet new people and never wants to stop learning. “Writing has always been a passion of mine,” said Carthel. “Doing this, I get to meet so many different kinds of people and see different parts of the community through their eyes. With journalism, and with writing, there’s always something new. A new story; a new angle; a new person to meet. It’s like a non-stop adventure, and I thin k that’s very exciting.”

k that’s very exciting.”

In addition to her duties as a reporter, Carthel has taken on full responsibility for the Chronicle’s social media sites including a brand new Facebook page. Visit the Chronicle’s new Facebook page at www.facebook.com /GCCChronicle.

In her spare time, Carthel enjoys spending time with her boyfriend, whom she met within two weeks of moving to Colorado, staying active, riding, running, reading, and sky diving. Carthel realizes she has an incredible opportunity working for the Chronicle. “I feel lucky that I get to do what I love and hopefully make a difference in the community.”

How To Keep Your Health Costs Low In 2016: Part II

by Shideh Kerman, BS, MBA

How can we save money by choosing the right Health Insurance plan?

Has this question ever crossed your mind? If yes, let me tell you that you are not the only one who had thought about lowering your medical insurance costs every time you see the high insurance premium expense or when you pay copays when visiting a doctor.

Three things you need to know when you are picking your health insurance:

- Decide what level of coverage you need that year.

- Review the total cost of your health plan.

- Check the plan network.

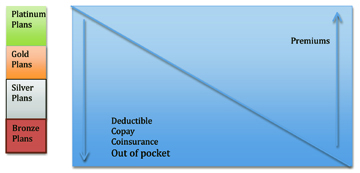

- Decide what level of coverage you need: The “metal” categories.

The Affordable Care Act (ACA) has prompted health insurance companies to offer health care plans in four categories. The category you choose determines how you and your plan share the costs of care. This structure helps make it easy to compare health care plans from a range of companies.

The Affordable Care Act (ACA) has prompted health insurance companies to offer health care plans in four categories. The category you choose determines how you and your plan share the costs of care. This structure helps make it easy to compare health care plans from a range of companies.

The plans are divided into four “metal levels,” plus catastrophic.

Plan Insurance Patient

Category Pays Pays

Platinum 90% 10%

Gold 80% 20%

Silver 70% 30%

Bronze 60% 40%

If you are under 30 years of age, you might be eligible to apply for a Catastrophic coverage. For more info go to the CMS website at https://www.cms.gov.

Just like car insurance, you pay for it hoping you never need to use it. Health insurance is for unpredictable and fundamentally serious health problems that occur in people’s lives. Health insurance covers these costs and offers many other important benefits.

In general if you are healthy and don’t need to visit the doctors, a bronze plan might be better choice. But if you need to see the doctor often and or have planned surgeries, having a plan that offers more coverage will save you a lot of money.

- Total Cost of your health plan.

You pay for health insurance in two ways:

- The monthly premium that you pay to purchase your plan.

- The fees you pay when you receive medical care. Those are some combination of

- Copay

- Deductible

- Coinsurance

- Out-Of-Pocket

COPAY — A copayment or copay is a fixed payment for a covered service, paid when an individual receives certain types of service.

For example, you might pay $50 for a doctor’s visit and the insurance company will pick up the rest. Plans with higher premiums generally have lower copays, and vice versa. And some plans do not have copays at all. They use other methods of cost sharing.

DEDUCTIBLE — The amount you owe for covered health care services before your health insurance plan begins to pay.

For Example, if your deductible is $2,500, then you would pay cash for the first $2,500 in health care you receive each year, after which the insurance company would start paying its share.

COINSURANCE — Is your share of the costs of a service that is covered by your health insurance.

For example if you need a CAT Scan that costs $1,500, you might pay 30 percent ($450). And your insurance company will pay the other 70 percent ($1,050). Plans with higher premiums generally pick up a larger portion of the bill.

OUT-OF-POCKET LIMIT — Out-of-pocket costs include deductibles, coinsurance, and copayments for covered services plus all costs for services that aren’t covered. Once you hit this limit, the insurance company will pick up 100 percent of your costs for the remainder of the year. Most people never pay enough for health care services to hit the out-of-pocket limit but it can happen if you require a lot of costly treatment.

In general, if you pay a higher premium upfront, you will pay less when you receive medical care, and vice versa. Below graph demonstrates how premiums affect out of pocket paid.

- Check the plan network.

Every health insurance plan has a network of providers such as doctors, hospitals, laboratories, imaging centers, and pharmacies that have signed contracts with the insurance company agreeing to provide their services to plan members at a specific price.

If a provider is not in your plan’s network, the insurance company may not cover the bill, or may require you to pay a much higher share of the cost. So if you have doctors you want to continue to see, you will want them to be in the plan’s network. Some most common networks are PPO, POS and HMO plans.

Preferred Provider Organizations (PPOs): PPOs give you the choice of getting care from in-network or out-of-network providers. You pay less if you use providers that belong to the plan’s network.

Point-of-Service (POS) Plans: POS plans let you get medical care from both in-network and out-of-network providers. If you have a POS plan, you’ll choose a primary doctor from a list of participating providers. Your primary doctor can refer you to other network providers when needed.

Health Maintenance Organizations (HMOs): HMOs usually limit coverage to care from providers who work for or contract with the HMO. An HMO generally won’t cover or has limited coverage for out-of-network care except in an emergency.

What plan is the right one for you depends on your health, your financial situation and the providers that you prefer to provide care for you.

- If you already know you have an expensive medical condition, consider a plan with a higher premium that covers more of your costs.

- If you are generally healthy you might come out ahead paying a lower premium and a bigger share of your health costs, because those costs are most likely not going to be that high. Of course, you need to be prepared to pay more if you do unexpectedly become sick or injured.

- If you have a primary care physician and specialists you like, be sure they’re in the network of any plan you consider buying.

Welcome To The Hotel Confusion

“You can check out any time you like, but you can never leave.” With the passing of rock legend Glenn Frey I couldn’t help but revisit the Eagles playlist on my podcast. The lyric I opened my article with always rings in my head for various reasons but mostly it’s a lyric I interpret as someone who checks out in their mind because they are stuck in a situation.

“You can check out any time you like, but you can never leave.” With the passing of rock legend Glenn Frey I couldn’t help but revisit the Eagles playlist on my podcast. The lyric I opened my article with always rings in my head for various reasons but mostly it’s a lyric I interpret as someone who checks out in their mind because they are stuck in a situation.

Related to dating and relationships I submit there are many of you out there who feel checked out in your relationship and feel like there is no way out. I know ultimately it is up to us as individuals to make decisions that are best for our own personal well-being and mental and physical health but we all know that’s not easy. It’s especially not easy when emotion and guilt are woven in to your decision making process. I rarely see an emotion based decision work out. Again, easier said than done, we are human after all.

But who wants to be “checked out” in life and feel like they can “never leave?” Not me! Let’s talk for a minute about what makes a person stuck in a relationship…

The following are signs that you may be checked out and stuck in a bad relationshit.

- You’re finding you care less and less about things that were very important to you and now you give up fighting for them because no matter how much you express yourself they just don’t care about what you find important.

- You find yourself angry at that person all the time even when there isn’t an immediate issue at hand. This comes from built up animosity that has not been addressed which, in turn, leaves you feeling empty, bitter and angry.

- You begin to start plotting exit strategies in your mind that you never follow through with because of some kind of guilt attachment you have with the other person, i.e., they helped you with something important at one point and it’s held over your head.

- You have positioned yourself to rely on your current partner and without them your lifestyle or creature comforts would be disrupted.

- You now avoid any kind of intimate contact with your partner because it seems forced and not genuine.

- You begin sabotaging your future with that person unconsciously by continually complaining to your friends and family about how miserable you are. Once you do this, of course your friends and family will side with you making it impossible for you and your partner to build a healthy future. Unless, of course, you don’t care about having friends and family in your life.

- Just like the lyrics say, you checked out and you find yourself not communicating even if you want or need to.

All of these signs are very dangerous. If you are experiencing any or all of the symptoms of a diminishing and dysfunctional relationship you need to push the pause button. You need to pause and ask yourself if you are living in a manner that is true to you. True to your expectations, values, goals and communication level needs to make you a growing, thriving and healthy person. Remember, disease causes disease.

It is very easy to get caught up moving in the wrong direction in life and if there is anything to take away from the Eagles great Glenn Frey, it’s this… Live your life to the fullest, be kind to people, do what you love and be true to what you want because being around tomorrow is no guarantee. Make today your day and lead with your heart, but follow with your fury.

Here’s to happiness and cutting the cancer out of your life once you identify it. Good luck!

Your pal, Sheik